Income Tax: Old regime is still beneficial for these taxpayers

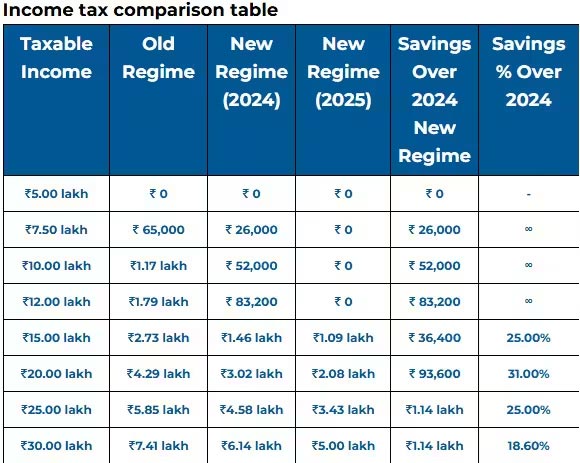

Income Tax: Finance Minister Nirmala Sitharaman gave a big relief to taxpayers on February 1. She announced zero tax on income up to Rs 12 lakh annually in the Union Budget. Salaried people will no longer have to pay tax on income up to Rs 12.75 lakh annually. The reason for this is standard deduction. Salaried people get the benefit of this.

Many announcements for the new regime

After the announcement in the budget by Finance Minister Nirmala Sitharaman, the new regime of income tax has become attractive. In the new regime, people earning up to Rs 12 lakh will not have to pay tax. The question is, if a taxpayer invests maximum in tax saving instruments, will the old scheme be beneficial for him? Tax experts say that if a person’s income is Rs 20 lakh, then even after investing in tax saving instruments, he will have to pay more tax in the old regime.

Who benefits, who loses?

If a person’s annual income is Rs 20 lakh and he claims a deduction of Rs 5.25 lakh, then also his tax in the old regime will be Rs 2.4 lakh, while in the new regime it will be Rs 2 lakh. However, for those people whose income is between Rs 13.75 lakh and Rs 15.75 lakh, the old regime will be beneficial for them. Many types of deductions are allowed in the old regime. Most of the deductions are not available in the new regime.

The new regime was started in 2020

The government started the old regime of income tax in 2020. The government introduced this regime for such taxpayers who do not claim deductions. The tax rates are low in the new regime, but most deductions are not available. But, it is quite easy. In this, tax can be calculated easily.

Deduction in the old regime

In the old regime, deduction is available under sections 80C, 80D and 24B of the Income Tax Act. About a dozen investment options come under 80C. Deduction is also available under this section on tuition fees of up to two children. A maximum deduction of up to Rs 1.5 lakh can be claimed under this section. Deduction is available on health policy under section 80D. A person above 60 years of age can claim a deduction of Rs 25,000. A person above 60 years of age can claim a deduction of Rs 50,000. Under section 24B, deduction is available on the interest on home loan. Its limit is Rs 2 lakh.

Tax-saving from HRA also

Deduction is also available on the principal of home loan. This deduction is available under the limit of Rs 1.5 lakh under section 80C. Apart from this, exemption is available on HRA in the old regime. This reduces the taxable income of the taxpayer significantly.

Who Benefits from the Old Tax Regime?

- Salaried Employees with High Deductions: Taxpayers who claim deductions under Section 80C, 80D, and HRA find the old regime more beneficial.

- Home Loan Borrowers: Interest deductions on home loans under Section 24(b) favor the old tax regime.

- Senior Citizens: Additional tax benefits under Section 80TTB make the old regime preferable.

- Self-Employed Individuals: Those who claim business expenses and tax deductions under Section 80C and 80D.

Importance of Professional Tax Consultation

With constantly evolving tax regulations, professional consultation is crucial. Tax Consultant Services in Delhi provide expert assistance in:

- Evaluating tax-saving opportunities.

- Filing income tax returns accurately.

- Ensuring compliance with changing tax laws.

- Maximizing benefits under the appropriate tax regime.

“ Choosing the right tax regime depends on individual financial goals. Seeking advice from a Tax Consultant Company in Delhi ensures maximum savings and compliance. ”

Conclusion

While the new tax regime simplifies tax calculations, the old regime remains beneficial for certain taxpayers who claim deductions and exemptions. Consulting with the Best Tax Consultation Company in Delhi can help you make the right financial decision. If you are unsure about which tax regime suits you best, reach out to professional Income Tax Services in Delhi today!